Connect with our team!

ValueMomentum at ITC Vegas

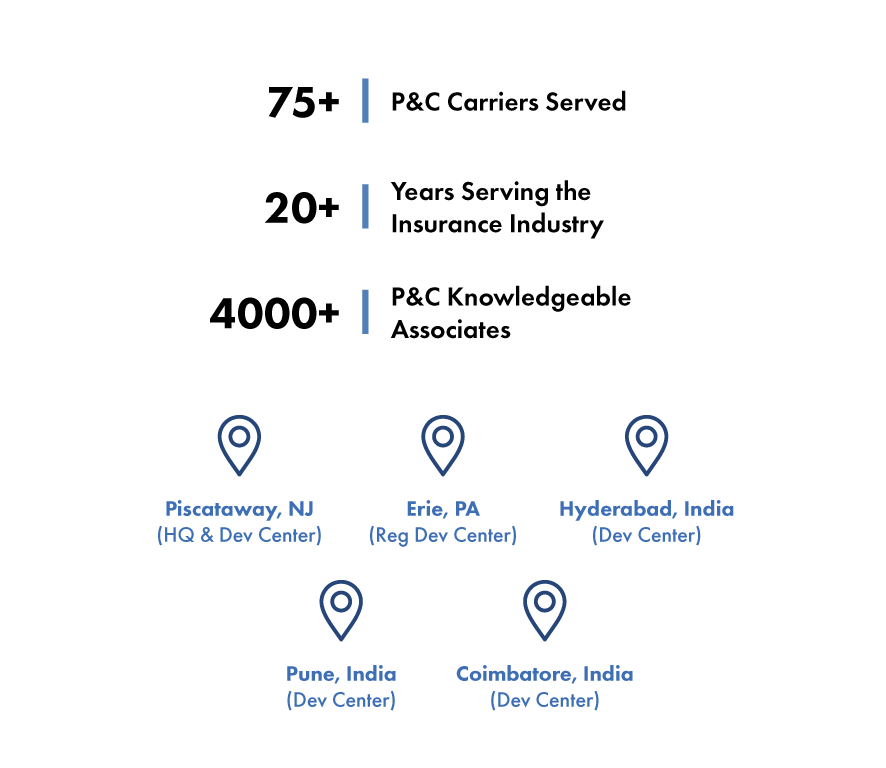

Insurance is the only language we code in. As an insurance-focused company with 20+ years of experience, 75+ insurance customers, and 4,000+ associates, we look forward to sharing firsthand knowledge and insights from our work helping insurers leverage technology to drive business growth.

We’re excited to be a Title Sponsor for this year's conference. We look forward to connecting with other innovative companies shaping the future of insurance and propelling the industry into a new era.

Request a personalized meeting or drop by the ValueMomentum booth to speak with our team about how ValueMomentum helps P&C insurers orchestrate operations, technology, services, and solutions every day to deliver successfully on their business outcomes.

Be sure to catch our speaking session on Thursday, November 2 from 11:10 AM to 12:00 PM in Mandalay Bay Ballroom H:

Strategies to Beat Uncertainty: Unlocking Business Growth in the Insurance Industry

The panel will be moderated by Jim Carlucci, President, ValueMomentum and will comprise of two insurance executives who lead their organizations' business and IT transformation efforts.

Jamie Kinsley

Deputy COO

Tokio Marine HCC

Adam Garey

SVP & CIO

Country Financial

James Carlucci

President

ValueMomentum

In today’s dynamic and uncertain business environment, the insurance industry faces unique challenges and opportunities. To achieve sustainable business growth, insurance companies need to navigate through uncertainty with strategic agility and resilience. This moderated panel discussion aims to explore key strategies and insights from insurance leaders who are spearheading transformation within their organizations.

Our commitment to the insurance industry extends beyond helping carriers become digital enterprises.

We help insurers develop and deliver Intelligent Automation for underwriting, expand Digital Distribution, enhance Claims Experiences, and embrace Product-Centric Delivery Models.

Learn more about our work below.

Intelligent Automation for Underwriting

As insurers expand their digital toolsets, they also expand their business opportunities and customer touchpoints. Intelligent automation has allowed underwriters to reduce their administrative workload and manual efforts. However, this shift has also led to an increase in issues like:

- Complex risk profiles

- High transaction volumes

- Indigestible data

- More potentially fraudulent online claims

Insurers must balance delivering optimal customer quotes with minimizing their overall risk exposure.

Digital Distribution

Carriers today are tasked with the unique challenge of meeting evolving customer demands for enhanced digital experiences while retaining the value of traditional sales channels and relationships made through brokers and agents.

Four key distribution models can help insurers tackle this:

- Embedded insurance bundles insurance offerings with a product or service in real time at the point of sale

- API marketplaces provide agents access to multiple carriers through a unified API for quoting and submission

- Insurance aggregators bring together multiple carriers to give customers and intermediaries access to varied options in one place

- Agency platforms are used by agents to partner with multiple carriers to provide products and services to their customers

Enhancing Claims Experiences

Claims are a key touchpoint with customers, and speed in the insurance claims process is highly important for achieving customer satisfaction. While most insurers have invested in digitalizing their claims processes, efficient claims management is still no simple task. Improving the insurance claims experience requires insurers to evaluate three main areas: the technology environment, the intake process, and the level of service.

Explore the resources below to learn more about how we're helping insurers evolve their claims experiences.

Product-Centric Delivery Models

Innovation has become critical to insurers' growth models. To keep up with this need, leaders have increasingly been following the "product turn," a management approach that centers around the life cycle of a product.

Traditionally, insurers have taken a project-centric approach, which usually sticks to a rigid (but exact) timeline with a linear set of objectives. Switching to a product-centric model focuses on creating ongoing iterations based on results, profits, and changing business objectives. While this approach carries more risks, it also brings more growth opportunity.

Meet Our Team at ITC

Jim Carlucci

President

Surya "Sunny" Mandapati

SVP

Abhijeet Jhaveri

Executive Vice President

Nachiket Pandya

VP, Partnerships & Alliances

Analyst Relations

Alexa Tarpey

Senior Marketing Manager

Ashok Murugesan

Associate VP

Subra Yedavilli

Director - Business Development

Ravi Nalliyappa

AVP Business Strategy

Learn Why the Top 25 P&C Carriers Trust ValueMomentum with Their Digital, Data, & Core Transformation Initiatives

Ready to connect with our team? Fill out this form to schedule your meeting with us at ITC Vegas!